Market Overview

The e-SIM card market is experiencing rapid growth as it represents a significant shift from traditional SIM cards to a more flexible and efficient solution for connecting devices to cellular networks. E-SIMs are integrated directly into a device’s hardware, eliminating the need for physical SIM cards and enabling more compact and versatile device designs. The adoption of e-SIM technology is driven by its benefits, including ease of use, enhanced security, and support for multiple network profiles.

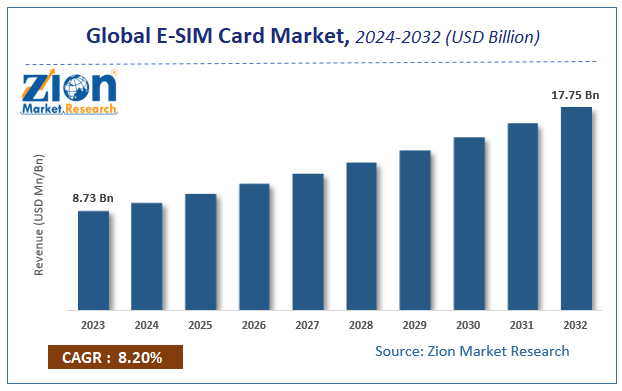

Market Size and Growth

As of 2023, the global e-SIM card market was valued at approximately USD 8.73 billion. It is projected to grow at a compound annual growth rate (CAGR) of around 8.2% from 2024 to 2032, reaching an estimated value of USD 17.75 billion by 2032.

Key factors contributing to this growth include:

- Increased Adoption in Consumer Electronics: Growing use of e-SIMs in smartphones, tablets, and wearables.

- IoT Expansion: Rising demand for e-SIMs in Internet of Things (IoT) applications, including smart meters, connected cars, and industrial devices.

- Advancements in Connectivity: Development of 5G networks and the need for more efficient and scalable connectivity solutions.

- Consumer Preference: Increasing consumer preference for devices with e-SIM capabilities due to their convenience and flexibility.

https://www.zionmarketresearch.com/sample/e-sim-card-market

Market Segmentation

By Type

- Integrated e-SIM: Built directly into the device’s hardware, providing seamless connectivity and reducing the need for physical SIM card slots.

- Removable e-SIM: Can be inserted or removed from devices, offering flexibility for users who require multiple SIMs or changing network profiles.

By Application

- Smartphones: Significant adoption in smartphones for enhanced connectivity and ease of switching between carriers.

- Wearables: Growing use in smartwatches and fitness trackers to enable cellular connectivity without the need for paired smartphones.

- Tablets: Increasing use in tablets for better connectivity options and improved user experience.

- IoT Devices: Application in various IoT devices, including connected cars, smart home devices, and industrial equipment.

- Other Applications: Including connected cameras, e-readers, and other consumer electronics.

By Region

- North America: Leading market due to advanced technology adoption, strong telecom infrastructure, and high smartphone penetration.

- Europe: Significant growth driven by advancements in connectivity technology and widespread adoption of e-SIMs in various devices.

- Asia-Pacific: Fastest-growing region with increasing consumer electronics sales, rapid IoT development, and expanding telecom infrastructure.

- Latin America and Middle East & Africa: Emerging markets with growing interest in e-SIM technology and expansion of telecom networks.

Key Trends and Innovations

- 5G Integration: Adoption of e-SIM technology to support the rollout and expansion of 5G networks, providing enhanced connectivity and performance.

- Enhanced Security: Development of e-SIMs with advanced security features to protect user data and prevent unauthorized access.

- Global Roaming: Increasing use of e-SIMs for global roaming solutions, allowing users to switch between different carriers seamlessly.

- IoT Connectivity: Expansion of e-SIM technology in IoT devices, enabling scalable and efficient connectivity for a wide range of applications.

- Consumer Convenience: Improved user experience with easy activation and management of multiple network profiles through software interfaces.

https://www.zionmarketresearch.com/custom/2682

Challenges

- Adoption Barriers: Slow adoption in some regions due to legacy systems and resistance to change from traditional SIM cards.

- Regulatory Issues: Varying regulatory requirements and standards for e-SIM implementation across different countries.

- Compatibility: Ensuring compatibility with existing devices and telecom infrastructure during the transition to e-SIM technology.

- Security Concerns: Addressing potential security vulnerabilities associated with e-SIM technology and ensuring robust protection measures.

Competitive Landscape

The e-SIM card market is competitive, with several key players focusing on innovation, partnerships, and expanding their product portfolios. Major companies in the market include:

- Gemalto (Thales Group): A leading provider of e-SIM solutions and secure connectivity technologies.

- Giesecke+Devrient (G+D): Offers a range of e-SIM products and services for various applications.

- NXP Semiconductors: Specializes in e-SIM technology for consumer electronics and IoT devices.

- STMicroelectronics: Provides e-SIM solutions and secure elements for a wide range of applications.

- Sierra Wireless: Focuses on e-SIM solutions for IoT and connected devices.

- Infineon Technologies: Offers e-SIM solutions with a focus on security and connectivity.

Future Outlook

The e-SIM card market is poised for robust growth, driven by increasing adoption in consumer electronics, expanding IoT applications, and advancements in connectivity technology. Innovations in 5G integration, enhanced security features, and global roaming solutions will shape the market landscape. Addressing challenges related to adoption, regulatory compliance, and compatibility will be crucial for sustained market expansion and success.

For specific forecasts and detailed insights into the e-SIM card market up to 2032, consulting specialized industry reports or market research firms focusing on telecommunications, consumer electronics, and IoT technology would provide comprehensive and up-to-date information.