The banking cyber security market is rapidly expanding as financial institutions prioritize safeguarding their digital infrastructure and protecting sensitive customer data. Cyberattacks targeting the banking sector, including ransomware, phishing, and data breaches, have become increasingly sophisticated, driving the need for robust cybersecurity solutions. Banking cyber security encompasses a range of technologies, practices, and services designed to mitigate risks, secure digital transactions, and ensure regulatory compliance.

Market Overview

The digital transformation of the banking sector has led to the widespread adoption of online banking, mobile applications, and cloud-based solutions. While these innovations have enhanced convenience and accessibility, they have also exposed the sector to vulnerabilities. Cybersecurity solutions in banking include network security, endpoint protection, identity management, and fraud detection systems, which together create a multi-layered defense mechanism against potential threats.

The rise in online financial transactions, along with stringent regulatory frameworks such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), is fueling the demand for advanced cyber security measures in the banking industry.

Request Free Sample: https://www.zionmarketresearch.com/sample/banking-cyber-security-market

Key Drivers of Market Growth

- Increasing Cyberattacks on Financial Institutions

The banking sector is one of the most targeted industries for cyberattacks due to the high value of its data. The frequency and sophistication of attacks, such as Distributed Denial-of-Service (DDoS), malware, and insider threats, are pushing banks to adopt cutting-edge cybersecurity solutions to protect their systems. - Growth in Digital Banking

The rise in digital banking services, including mobile banking apps and internet banking, has created new attack vectors for cybercriminals. As banks embrace digital platforms to cater to tech-savvy customers, the need for advanced cybersecurity solutions has become critical to safeguard these channels. - Stringent Regulatory Requirements

Governments and regulatory bodies worldwide are enforcing stricter compliance requirements to ensure the protection of customer data and secure financial systems. Banks are investing in cybersecurity technologies to comply with these regulations and avoid hefty penalties. - Advancements in Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are playing a crucial role in detecting and responding to cyber threats in real time. These technologies enable predictive analytics, automated threat detection, and adaptive security measures, enhancing the effectiveness of cybersecurity systems. - Adoption of Cloud-Based Solutions

The increasing use of cloud computing in banking has created new challenges for data security. Banks are leveraging cloud security solutions to ensure data protection, compliance, and secure operations across hybrid and multi-cloud environments.

Segmentation of the Banking Cyber Security Market

- The global banking cyber security market is segmented as follows:

By Component

- Solution

- Hardware

By Deployment

- On-Premises

- Cloud

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Insights

- North America:

North America dominates the banking cyber security market due to its mature banking infrastructure, high adoption of digital technologies, and significant investments in cybersecurity. The U.S. is at the forefront, with major banks focusing on advanced solutions to counteract rising cyber threats. - Europe:

Europe is a key market driven by stringent regulations like GDPR and initiatives by the European Banking Authority (EBA) to enhance cybersecurity in financial institutions. Countries like the UK and Germany are major contributors to the market’s growth in the region. - Asia-Pacific:

Asia-Pacific is witnessing rapid growth, fueled by the increasing adoption of digital banking services in countries such as China, India, and Japan. The rise in cyberattacks in the region has prompted banks to invest heavily in cybersecurity solutions. - Middle East & Africa:

The banking sector in this region is increasingly adopting cyber security solutions to address the growing threat of cybercrime. Governments and financial institutions are collaborating to improve cybersecurity frameworks.

Future Outlook

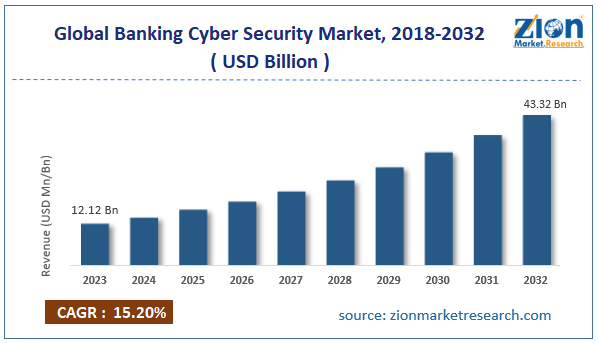

The banking cyber security market is poised for substantial growth, driven by the increasing complexity of cyber threats and the need for advanced solutions to secure digital banking platforms. Innovations in AI, blockchain, and quantum computing are expected to revolutionize the market, offering more robust and adaptive security measures.

Financial institutions must continue to invest in cybersecurity to protect customer trust, comply with regulations, and stay ahead in an increasingly digitalized and interconnected world.